Oceans cover more than 70% of the planet, producing at least 50% of the oxygen and absorbing at least 25% of all the atmospheric CO2. Building a sustainable ocean economy is a triple win for people, planet, and the economy.

As John Kerry, US Special Presidential Envoy for Climate, continues to high-light the inextricable link between oceans and the climate, UN Sustainable Development Goal 14: Life Below Water is starting to make its way on to impact investment agendas.

At $1.92bn, SDG 14 was the least funded of the 17 goals in 2019, but as the United Nations Decade of Ocean Science for Sustainable Development (2021-2030) kicks off in earnest, investors are starting to see purpose and power of the blue economy. To make a difference, SDG 14 needs an annual of $174.52bn.

According to the High Level Panel for a Sustainable Ocean Economy-commissioned research, investing one dollar in certain ocean themes can yield at least five dollars in global benefits over the next 30 years to 2050. Specifically, investing $2trn to $3.7trn globally from 2020 to 2050 across four key areas, could generate $8.2trn to $22.8trn in net benefits, a rate of return on investment of 450% to 615%.

The four key areas, whose impact reaches beyond just the ocean, are: conserving and restoring mangrove habitats; scaling up offshore wind production; decarbonising international shipping; and increasing the production of sustainably sourced ocean-based proteins.

Providing the main source of protein for more than one billion people and livelihoods – with more than 200 million working in marine fisheries alone – means that ocean investing impacts several other SDGs including zero hunger, decent work and economic growth, and industry, innovation and infrastructure.

The blue economy

With assets valued at $24trn in 2015 and the annual value of goods and services produced from ocean-related economic activities estimated at $2.5trn, the investment case is not complicated. The challenge, however, is finding ways to drive both sustainable impact and returns, at scale.

The drive to stimulate an ocean-focused economy started in 2018, when the World Bank’s launched PROBLUE, a multi-donor trust fund to help countries chart a course towards a blue economy approach. Since then, it has supported more than 100 activities in 70 countries and the 12 development partners have contributed more than $200m.

The World Bank was also behind the first sovereign blue bond, which was issued in 2018 by the Republic of Seychelles, attracting investors such as Calvert Impact Capital, Nuveen, and Prudential Financial that helped to raise $15m. Since then, the Bank of China raised $942m in blue bonds in 2020, and the Nordic Investment Bank issued a €200m Nordic-Baltic Blue Bond.

In terms of scale, it looks like blue bonds could follow in the footsteps of its green bond sister, a market that was valued at $433.30bn in 2021. In April 2022, the Asian Development Bank (ADB), supported by the Asia-Pacific Climate Finance Fund, launched the world’s first blue bond incubator to help scale up sovereign and corporate blue bond issuance for the protection and restora-tion of oceans in Asia Pacific.

With industry commitments of more than $91bn, the Blue Bond Incubator is part of ADB’s Action Plan for Healthy Oceans and Sustainable Blue Economies that aims to invest and provide technical assistance of at least $5bn by 2024. The development bank issued its first ever dual-tranche blue bonds in 2021. “Ocean-based climate mitigation and resilience are key to climate change action,” said Bruno Carrasco, director general of ADB’s Sustainable Development and Climate Change department.

In 2022, the Bahamas issued a $385m blue bond guaranteed by the Inter-American Development Bank, while Alecta, the fifth largest pension fund in Europe, opted to allocate $77m to the $364m Belize blue sovereign bond issued together with The Nature Conservancy.

“Belize Blue Bond meets our requirements for both long-term sustainability and good returns at a limited risk. The investment in the bond therefore fits well into our investment model,” said Ulrika Torell, senior portfolio manager at Alecta.

Through the blue bond, Belize can reduce its external debt by approximately 12% of GDP while generating approximately $180m for projects aimed at protecting 30% of its ocean, strengthening governance frameworks for domestic and high sea fisheries, and establishing a regulatory framework for coastal blue carbon projects.

Beyond blue bonds

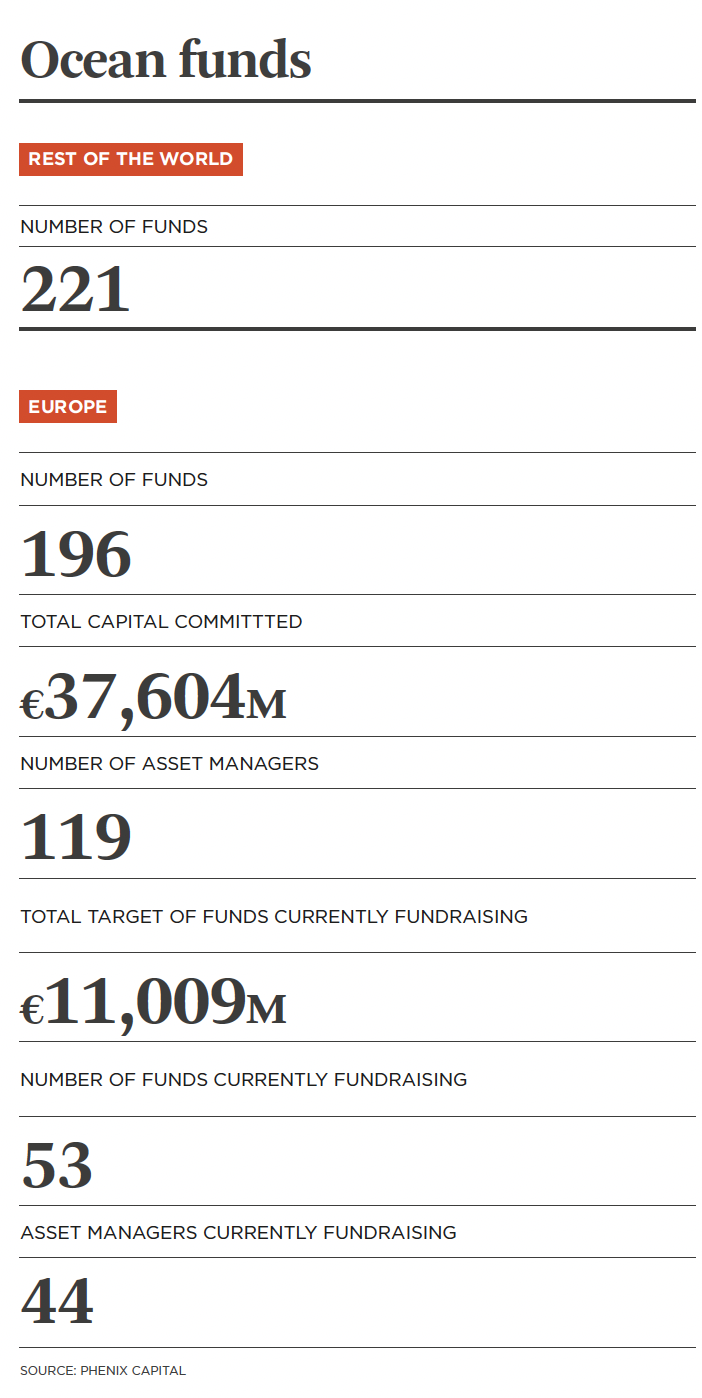

Beyond blue bonds, investors can also access the blue economy, which if it were a country would make it the seventh largest in the world, via public and private equity. Phenix Capital’s impact database currently tracks €37.6bn in assets in 196 ocean themed funds run by 119 managers in Europe alone.

In 2020, Credit Suisse, Rockefeller Asset Management and The Ocean Foundation launched the Credit Suisse Rockefeller Ocean Engagement Fund, which initially raised $780m. In the same year, Mirova launched the Althelia Sustainable Ocean Fund which closed at $132m, with commitments from investors including the European Investment Bank, Axa Investment Managers, IADB, FMO, and Caprock Group.

A popular investment theme is ocean plastic pollution. The Ellen MacArthur Foundation predicted that plastic will be greater than fish by weight by 2050, while another study estimates that ocean plastic pollution costs society up to $2.5trn a year. In 2019, Morgan Stanley served as the sole underwriter for a $10m 30-year issuance by the World Bank aimed at solving the challenge of plastic waste pollution in oceans.

The European Investment Bank announced plans to allocate up to $20m to the Circulate Capital Ocean Fund, a private equity fund targeting investments that combat plastic waste in South and Southeast Asia. “Preserving the health of our oceans is key to tackling climate challenges and preserving our economic prosperity,” said Ricardo Mourinho Félix, vice president, EIB.

The Circulate Capital Ocean Fund has also attracted $10m from the International Finance Corporation, half of which comes from the Finland IFC Blended Finance for Climate Change Program, and nearly $6m from Proparco, a subsidiary of Agence Française de Développement. Private investors in the Circulate Capital fund include Benjamin Duncan Group, Huang Chen Foundation, Jebsen & Jessen, North-East Family Office and the Woodcock Foundation.

The David and Lucile Packard Foundation, the Nippon Foundation and the Gordon and Betty Moore Foundation all have a marine-based philanthropic focus, as do the Walton Family Foundation and the Minderoo Foundation, which have invested in both the Circulate Capital Ocean Fund and Ocean 14 Capital’s blue economy private equity fund.

“In line with SDG 14, our key objective through the Flourishing Ocean’s initiative is to return our ocean to a healthy thriving state,” said Dr. Tony Worby, CEO of Minderoo’s Flourishing Ocean initiative, which supports research projects such as the Global Fishing Index and Global Plastic Watch.

“To facilitate this, we are committed to ending overfishing; ending the dumping of plastic, heat and CO2 in our ocean; supporting the sustainable use of ocean resources; conserving key habitats; and facilitating world class research,” added Worby.

Other investors in Ocean 14 Capital’s fund include the European Investment Fund, Chr. Augustinus Fabrikker and, more recently, the Constitutional Reserve Fund of Monaco. While Louis Dreyfus Company is a strategic investor in the aquaculture-focused fund run by Aqua-Spark, and Norway’s Ferd family office has invested in SWEN Blue Ocean Capital Partners.

Covering more than 70% of the planet, producing at least 50% of the oxygen and absorbing at least 25% of all the atmospheric CO2 produced, building a sustainable (and regenerative) ocean economy is a triple win for people, planet, and the economy.

“Ocean investing is crucial for protecting biodiversity and to tackle the problems of pollution and over fishing. It is hard to imagine a healthy planet if we are not able to protect the life in our oceans,” said Dirk Meuleman, CEO at Phenix Capital.

This article is part of the editorial content of the Impact Investor Guide 2023. You can download a digital copy of the guide here.