Guide 2024: The majority of private debt impact funds invest in emerging markets. What needs to be done to accelerate the mobilisation of capital into the sector from a wider universe of investors?

British International Investment (BII), the UK’s development finance institution (DFI) recently signed an agreement with ILX to co-finance up to $500m (€472m) of debt transactions to facilitate long-term sustainable development across developing economies and low-income countries in Africa, Asia, and the Caribbean.

BII and ILX will invest across a broad range of sectors including renewable energy, infrastructure, financial services, manufacturing and agribusiness to increase the flow of capital into impactful businesses and projects.

This is just one example of the growing number of private debt impact funds that are allocating to emerging markets.

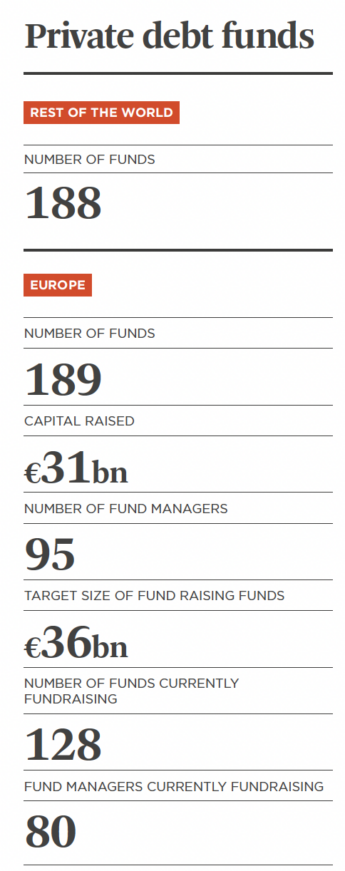

A recent report from Phenix Capital found that the number of private debt funds has grown by 219% since 2014, with more than two-thirds of the total allocating funds to emerging markets.

The rise in private debt impact funds comes as traditional bank lending into impact investment strategies is becoming more expensive and harder to access.

This new partnership will enable both parties to leverage each other’s expertise and provide additional financial firepower across Africa, Asia and the Caribbean. ILX and BII will share information on prospective projects, emerging technologies, and financial innovation.

They will also establish a roadmap to mobilise private sector capital, specifically focusing on providing institutional investors with greater access to high-impact private debt investment opportunities in scalable businesses driving productive, sustainable and inclusive growth.

Nick O’Donohoe, CEO at BII, says of the deal with ILX: “This partnership has been driven by our shared view of the need to invest to meet the UN SDGs. It furthers our ambition to create new job opportunities in developing economies and will provide private credit to help bridge the finance gap faced by many businesses.” He adds: “This asset class remains nascent, comprising just 3% of private credit globally, and is the natural next step for allocators of global private credit.”

Manfred Schepers, CEO at ILX Management, has noticed increased investor appetite for private debt impact funds following the volatility in public bond markets that followed the geopolitical risks emanating from Russia’s invasion of Ukraine, and the overall increase in interest rates.

Catalytic effect

Joe Mate, investment director, intermediated credit at BII, says the development impact from investing in private credit impact funds in emerging markets is two-fold.

Schepers says: “Investors are increasingly exploring private debt opportunities in emerging markets due to the stable risk-adjusted returns the asset class offers”.

“From ILX’s experience, when looking at financing private debt in emerging markets alongside multilateral development banks (MDBs) and development finance institutions (DFIs), we have established that MDB and DFI loans show a lower loss given default and therefore a higher recovery rate, compared to other asset classes, such as EM corporate or sovereign debt. This results in a strong diversifying effect of this asset class on investors’ portfolios.”

Firstly, he explains, this type of private lending provides much needed growth capital to mid-sized businesses, which “will lead to more employment opportunities and goods and services for consumers, as well as a greater contribution to the broader economy through increased taxation”.

“In addition, by undertaking the required financial, ESG and business integrity reporting, these companies may be better positioned to access public markets in the future,” he adds.

Another important point is that capital flow to private credit “will have a catalysing effect by reducing the uncertainty in this asset class and demonstrating that this is an investable strategy with sufficient opportunities that can generate commercial returns”, Mate says.

Impact and financial returns

Vincent Lemaitre, head of ESG for private debt at Tikehau Capital, believes there is a growing recognition of the potential for financial returns that create positive social and environmental outcomes.

He says: “Impact investments are no longer seen as a trade-off between financial returns and impact, they’re an opportunity to achieve both.”

Impact lenders typically have strong internal expertise in sustainability, having proactively invested in this field ahead of their peers. They leverage this expertise to guide companies in formalising and strengthening their positive impact approach.

“Through their expertise, they help establish standardised impact metrics, implement measurement tools for evaluating social and environmental aspects, enhance reporting and transparency practices and, to a certain extent, assist companies in optimising their societal contributions.”

Rik Klerkx, head of private markets at Cardano Asset Management, is keen to dispel the myth that privately funded impact funds are too risky for some institutional investors to contemplate.

Cardano’s Financial Inclusion Fund, which operates to achieve a variety of the UN’s SDGs, attracted a wide range of institutional investors and through the fund they provide financial products and services to micro, small and medium-size enterprises, as well as low-income households, who would otherwise have been unable to gain access to finance.

Klerkx says: “In total, 10% of all clients were previously unbanked individuals and entities, demonstrating progress in expanding financial services. This means that about 6m household members can benefit from financial products and services and additional sources of income.”

Cardano’s SME Finance Fund invests in financial institutions in emerging and developing markets with the aim of providing investors with a market- based financial return, while at the same time contributing to closing the finance gap for SMEs, fostering a dynamic SME sector, and contributing to job creation and economic growth, Klerkx adds. This kind of impact investing helps reduce inequalities within and among countries.

Impact themes

Lemaitre says that outside of emerging markets, the most common themes addressed by impact funds are healthcare, climate (SDG 13-7 and 11-12), biodiversity (SDG 15) and water (SDG 14).

Earlier this year Tikehau Capital launched a thematic impact fund that aims to contribute to climate change mitigation by mobilising the capital of individual investors to promote decarbonisation and accelerate the decarbonisation strategies of European SMEs.

Lemaitre says: “We believe that reducing GHG emissions in Europe can have a significant impact on global warming, including in emerging and developing countries.

“This is because addressing emissions in Europe, which is among the largest emitters, is fundamental for safeguarding the stability of our planet, as these efforts transcend borders with far-reaching global environmental consequences.”

Institutional investors

Despite the best efforts of existing private debt impact funds and the organisations that allocate to them, the UN estimates that the funding gap to achieve its 17 SDGs by 2030 stands at between $2.5trn and $3trn and could be as high as $1trn a year.

One solution to help reduce this enormous deficit would be for institutional investors such as pension funds and insurance groups to increase their allocation to private debt impact funds.

Isabella da Costa Mendes, founding partner at ImpactA, says: “Traditional lenders are naturally constrained from participating in some of these opportunities as high capital requirements make taking long-term credit risk in emerging markets increasingly difficult for banks.”

To mobilise institutional money to the sector several steps are needed, she says. “MDBs and DFIs need to review the way in which they deploy capital to maximise their contribution, mitigate perceived political risks and motivate private capital to come in at scale.”

She also advocates “more standardisation of PPP and financing frameworks in emerging markets”.

Data transparency

Another step that is urgently needed to mobilise capital to close the SDG funding gap is to change investor perception about the perceived risk of investing in private debt impact funds.

Schepers says this requires data transparency on loan performance. As he points out, MDBs and DFIs have a long track record of arranging private loans in emerging regions and share their default and recovery data with the GEMs database.

“However, this database is not publicly accessible which increases the difficulty of convincing investors about the perceived versus actual risks of invest-ing in emerging markets,” he says.

“This lack of data transparency also feeds into the distortive use of public finance in blended structures. In some instances, blended vehicles can be great tools to mobilise capital into certain high-risk markets or sectors. However, many emerging market private debt investments do not require any subsidy or risk coverage.”

He adds that subsidised risk-mitigation structures work against the development of a market-based competitive financial landscape — which is vital to entice institutional capital to the sector.

Finally, there is a role for MDBs and DFIs to scale up their pipelines and fulfil their role as market creators, moving into less established markets.

“This can be achieved by providing technical assistance and capacity development, through syndicating projects via their lender-of-record status, leveraging their callable capital for capacity expansion and in general by prioritising their mobilisation mandate,” Schepers concludes.

This article is part of the editorial content of the Impact Investor Guide 2024. You can download a digital copy of the guide here.