The Dutch-based investor is targeting a €150m final close in 2026 for its debut offering, which has backing from the European Investment Fund and Invest International.

SevenGen Investment Partners, an Amsterdam-based investment firm, said it had reached a first close of €65m in total commitments for its debut fund, which is aimed at supporting northwest European companies active in the energy transition and related industries.

The European Investment Fund (EIF) and Dutch government-founded Invest International are anchor investors for the SevenGen Growth Fund, which is targeting a final close of €150m in 2026. Others in the investor group include Belgian family-owned impact investor Victrix and Rotterdam-based family office Alphatron, among others.

In February, SevenGen said that EIF had committed €50m to the fund, following on from a €10m commitment by Invest International.

The fund will provide growth capital to support the scale-up of companies in sectors deemed critical to Europe’s climate and biodiversity goals and industrial resilience, such as the energy transition, decarbonisation, circular materials and sustainable mobility.

The plan is to invest in some 10 northwest European growth companies, with initial tickets between in the €5m to €15m range. SevenGen said that the Article 9 fund aims to deliver “top-quartile financial returns and top-quartile impact”. The company has yet to detail any investments.

Frederik Deutman, a co-founder of SevenGen Investment Partners, said that, while Europe had world-class innovation in climate tech, the continent often lost out at the growth stage, when successful firms were acquired or outpaced by better-funded US and Asian rivals.

Allowing firms to compete

He told Impact Investor the fund aims to provide the support needed to allow them to compete financially and scale to a point where they can drive costs down.

“We invest in impact companies that are becoming mature businesses. They often still need growth capital to scale, but their products and technologies are already price competitive or moving in that direction. In some sectors, such as solar energy, sustainable solutions are already cost competitive, while in others like electric mobility that transition is still underway,” he said.

SevenGen noted it had launched the fund against a challenging backdrop, in a year where only a relatively small number of debut funds had reached the market.

Deutman said “an institutional approach combined with entrepreneurial experience and a clear investment focus” had helped, with the commitment of EIF and Invest International building confidence and momentum.

“We are one of the few teams that has been investing in this specific segment since 2018. Investors value that experience and our focus on companies with strong fundamentals and measurable climate impact,” he said.

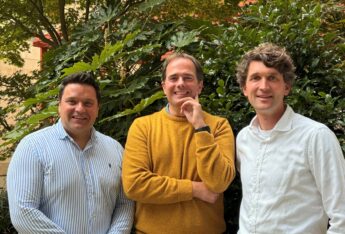

SevenGen was founded in 2023 by Deutman, fellow managing partner Pieter Smit and a small group of other bankers with a track record in climate finance deals.