The UK’s Big Issue Invest has opened applications for its fourth social impact debt fund. We meet with investment director James Potter to understand how it works.

Big Issue Invest, the investment arm of the Big Issue Group, publisher of the eponymous newspaper, was founded in 2005 to finance the growth of sustainable social enterprises.

It currently manages or advises on over £460m (€529m) of impact funds. Since 2005, it has provided £46m in impact loans to more than 100 social enterprises, alongside nearly £35m in larger and more patient investments, coming from three funds with a committed capital of nearly £43m.

Last week, it launched its Social Impact Debt Fund IV which will provide ‘unitranche’ funding of up to £4m to impactful enterprises in the UK with balance sheets to support secured debt or contract income.

Investment director James Potter tells Impact Investor: “This unitranche fund represents something new in the social impact space. We are taking on both the senior debt and the mezzanine debt, and not involving banks. The consequence of this is that we have more control because otherwise banks tend to be in the driving seat. We’re able to do this because this is a larger fund and because the vast majority of our investments will be backed by property assets making this low risk lending.”

How the fund will work

The fund is calling for applicants from three core sectors – health and social care, affordable housing, and social infrastructure. For the organisation, social infrastructure encompasses buildings and other assets in the community that are used to provide an impactful service, such as preschool nurseries, vocational education and training, specialist schools, arts and performance venues, or co-working spaces.

Potter says: “We chose these three sectors because they are symptomatic contributors to poverty and inequality. Our overriding objective is to change lives through enterprise.”

Anticipated loans will be fixed rate, sized between £1m and £4m with expected terms of three to five years, with plans to offer loans greater than £4m in due course.

Eligible borrowers will be established socially impactful organisations in the UK. “We will vet candidates on a series of criteria,” Potter continues. “They must be achieving social impact in one of these three sectors; their business must be established and sustainable with a good history of revenue and profitability; and they must have the ability to support secondary debt.”

Historically, almost all Big Issue Invest’s investees are unable to raise mainstream finance. The group says “80% of investees became more financially sustainable as a result of our investment, and more than half were able to hire new staff last year”.

Social enterprises borrowing from the fund are expected to deploy the funding to improve their financial sustainability and scale up existing impact. Acceptable use of proceeds would therefore include expansion of services, property refurbishment or acquisition, purchase of capital equipment, or improving cash profitability.

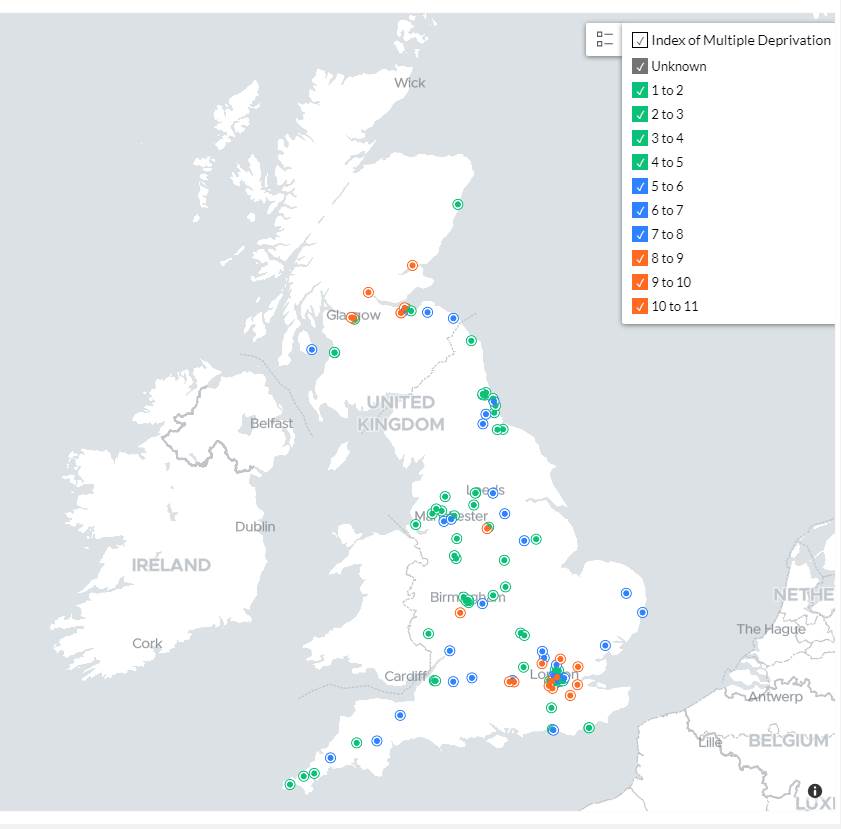

The fund intends to lend in a wide range of geographies across the country. “Our focus is on delivering impact across the UK not just in London, something we have focussed on long before people talked about levelling up,” Potter adds. “If you look at a map of where our investments are [see above] you will see that we have particularly targeted those areas such as the NE which tend to be under represented in many impact funds.”

The bigger picture and the future

The plenty has plenty of past successes in previous impact funds, including The London Early Years Foundation, in the nursery success sector; Homes For Good, an affordable homes provider in Scotland; and Be Caring, an employee owned social care provider business.

This fund launch is part of a broader investment strategy. Big Issue Invest is also bringing the mainstream to social investment with the UK Equity Impact – Employment Opportunities Fund, in partnership with Aberdeen Standard Investments, and the UK Social Bond Fund, in partnership with Columbia Threadneedle. The latter is the first social investment fund offering daily liquidity. Through partnering with Experian on The Rental Exchange, Big Issue Invest is also helping to pave the way for 3.4m social housing tenants to potentially improve their credit files.

Looking to the future, Potter sees “demand in the sectors we are targeting is increasing and not necessarily being fulfilled. It is therefore our intention to launch more funds to address the continuing problems in these three sectors”.