GIP Zambia, with $70m of initial funding, builds on a model developed by BII and its partners in Ghana to provide finance for firms overlooked by the existing banking system.

British International Investment (BII), Swedfund and Zambia’s National Pension Scheme Authority (NAPSA) have launched an investment company to provide long-term, flexible capital to SMEs in Zambia, backed by $70m (€60.3m) of initial funding.

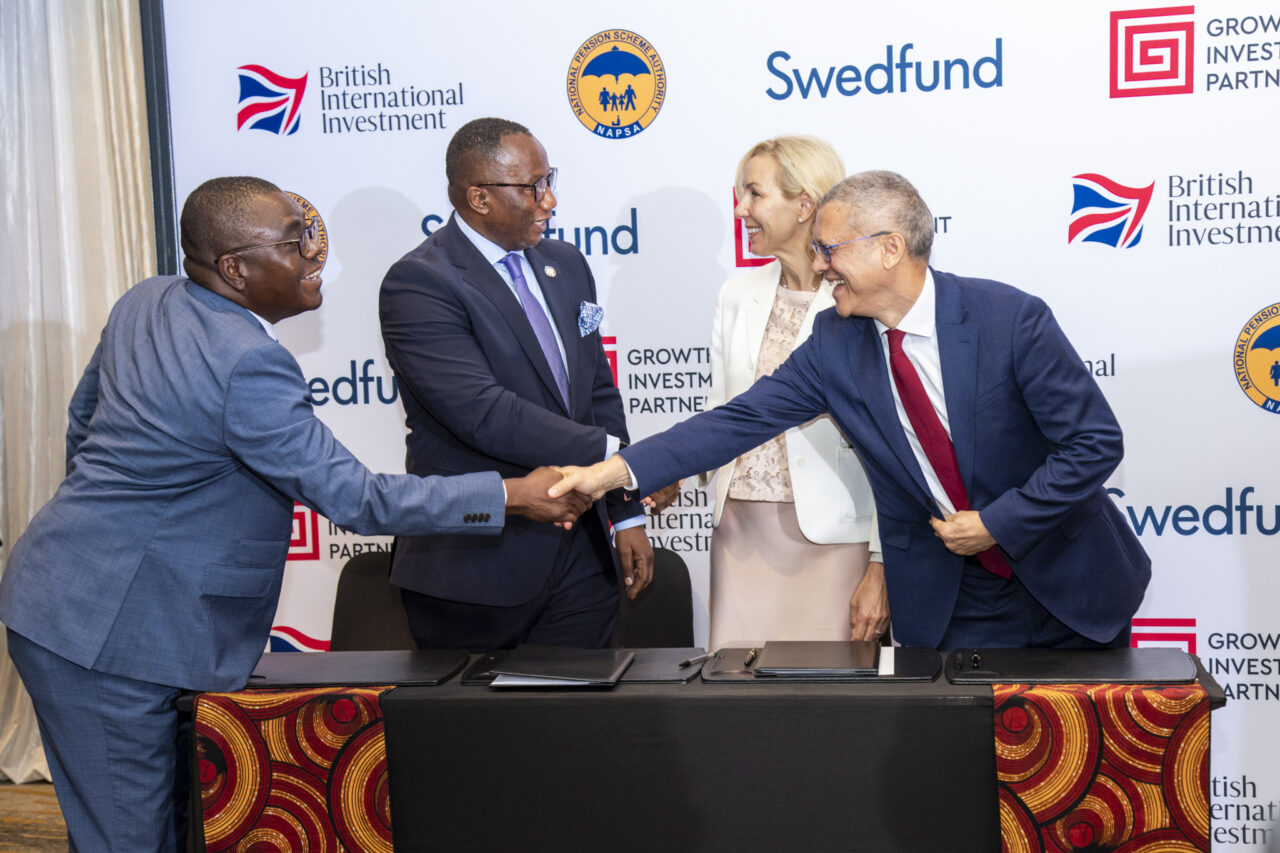

BII, the UK’s development finance institution, contributed $37.5m, Swedish DFI Swedfund committed $15m and NASPA provided $17.5m in funding for Growth Investment Partners Zambia (GIP Zambia). The launch event in Lusaka was attended by Zambian president Hakainde Hichilema and officials from the organisations involved.

The company will provide capital mainly in local currency, with the aim of tackling a long-term acute shortage of financing that has held back growth of a sector that drives the Zambian economy. SMEs account for more than 70% of the country’s GDP and provides 88% of employment, according to BII.

BII said the early involvement of NAPSA, Zambia’s largest pension fund, showed local confidence in the model and that BII was talking to other domestic institutional investors in Zambia about joining future funding rounds.

The Zambian government has set long-term development goals that prioritise private sector development, job creation, and economic diversification. The economy has outperformed expectations recently, with the International Monetary Fund (IMF) forecasting real GDP growth of 5.8% in 2025.

Growth has been driven by stronger than expected activity in high tech industries, financial services and construction, while the agricultural sector has weathered the impacts of a severe drought in 2024 better than initially envisaged, according to a recent report by the IMF.

However, as elsewhere in the developed world, Zambia’s SMEs struggle to attract conventional bank lending or the interest of the private equity sector, given the low ticket sizes and long-term investment horizons involved. BII said over 40% of Zambian SMEs it surveyed reported challenges in accessing financing that addresses their growth needs.

Flexible lending

GIP Zambia aims to provide financing complementing that already provided by banks and others by offering longer tenors, lower collateral requirements, more flexible repayment arrangements and risk sharing, and more customised business support.

Funding will be provided to SMEs that contribute to job creation with annual revenues and assets between $100,000 and $15m, and financing needs of $500,000 to $5m.

GIP Zambia is seen deploying more than $300m to 150 SMEs over the next 15 years, helping to create jobs and make SMEs more attractive for investors from traditional capital markets. Key economic sectors to be prioritised include manufacturing, agriculture and financial services. BII said there would be strong focus on inclusive business ownership, notably support for women and locally owned and led firms.

GIP Ghana is headed by Musonda Chipalo, who has spent much of his career working in finance at the International Finance Corporation.

The company has built on a template developed in Ghana, where GIP Ghana was launched in 2023 to provide SME financing by a partnership of BII and local partners. BII said the transfer to Zambia showed the GIP model could be a scalable and replicable method of SME financing across Africa.

Leslie Maasdorp, BII’s CEO said GIP Zambia built on the DFI’s experience of launching GIP Ghana and reflected its long-term commitment to building local financing ecosystems for SMEs and entrepreneurs.

“We believe this is how catalytic development finance should operate – working with domestic partners to mobilise capital, support entrepreneurs, and deliver real economic transformation,” he said

Shipango Muteto, chair of NAPSA’s board, described the launch of GIP Zambia as a significant milestone for the pension fund that would channel much-needed patient capital into SMEs comprising the backbone of the economy.

“For NAPSA, this is not just an investment – it is an imperative that directly contributes to growing our membership base, thereby strengthening the long-term sustainability of the pension fund and securing the future of our members,” he said.