Catastrophe bonds, or cat bonds, are attracting more interest from investors looking for opportunities in the fast-growing insurance linked securities. We meet some of the players in this space to understand how the sector is developing.

In brief

- “Cat bonds are all about markets transferring peak natural catastrophe risks from those taking out insurance to capital markets in general.”

- Investors are attracted by high returns and diversification. But impact and ESG arguments are also growing.

- As climate change risk increases, the sector looks set to grow more as it broadens out into more issuers and new regions.

“ILS [insurance linked securities] emerged in the mid-1990s following Hurricane Andrew and the Northridge Earthquake. Today ILS is established, representing approximately 15% of global reinsurer capital,” explains Vegard Nilsen, CEO at Securis Investment Partners.

Catastrophe bonds, or cat bonds, are a major part of that. The market has seen significant growth in recent years and Sophie Ware, senior vice president at Neuberger Berman believes the sector looks very different in terms of depth and breadth to the early days of the asset class. “2023 is off to a record H1 start with $12.5bn of issuance to date and a consensus view full year issuance will breach $15bn,” she says. The current outstanding market is around $40bn.

Paul Wilson, the partner at Securis responsible for understanding the scientific risks, explains that the tools and techniques cat bond experts use to model catastrophe risks have also evolved significantly and “are being adapted to the changing climate”.

Attraction to investors and managers

The complexity of the task is one of the attractions for managers since as Ware notes it provides “relatively high barriers to entry”.

Wilson points that the investment process uses “sophisticated, in-house, proprietary technology and the strategies are supported by specialised skillsets and highly experienced individuals”.

This does indeed put some off. Nelson Ribeirinho, fixed income portfolio manager at Mirova says: “Catastrophe bonds have a substantial contribution to make…they require a significant amount of data in order to predict the likely probability of disasters, but in reality this is very difficult to get.”

But from the investor’s point of view, Stephan Ruoff, global head of ILS at Schroders Capital, says there are “significant attractions”, including uncorrelation. “General financial market turmoil does not tend to have much impact on the cat bond market.” In addition, he adds, “the asset class has so far delivered fairly good returns historically”.

The Swiss Re cat bond index shows a return of over 6.5% over the last 20 years with very low volatility. Ruoff also think cat bonds tend to be “a good inflation shield as they use floating rates for the collateral (repriced every 3 months) and have stable risk spreads”.

In consequence, cat bonds have a real appeal to a broad range of investors including major pension funds and other institutions. “Family offices are also increasingly attracted by the very high yields available which currently are getting as high as 15%.”

ESG angle?

“There is a strong ESG angle to this asset class. Over 60% of Schroders Capital ILS assets are classified as Article 8 under the EU’s SFDR. In addition there are some cat bonds which use ESG-friendly collateral (such as IBRD bonds) thus further increasing the ESG credentials. Cat bonds are also increasingly used with a development angle such as the Chile earthquake bond,” explains Ruoff.

A point Ware concurs with. “Market participants are increasingly recognizing cat bonds for their inherent social impact. The nature of a cat bond means it provides an element of disaster risk financing – this is most obvious in the World Bank issuance program designed to provide redevelopment finance following a covered event. These bonds are structured so there is a quick and efficient payout mechanism.”

Effects of climate change

And the attractions for issuers? Ruoff says: “Cat bonds are all about markets transferring peak natural catastrophe risks from those taking out insurance to capital markets in general.”

According to Ware, climate change uncertainty is one of the factors helping to drive new issuance, “as the importance of risk management comes to the foreground for groups like corporates. It also encourages reinsurers and insurances to adopt a pre-event approach to disaster response and better event accountability”.

Natural catastrophe losses have increased over the years, but according to Ware “analysis actually shows this is due to …greater population density, and higher property values and the impact of inflation rather than due to climate change”. That said, “certain types of non-peak peril do appear to be more susceptible to changes in patterns”.

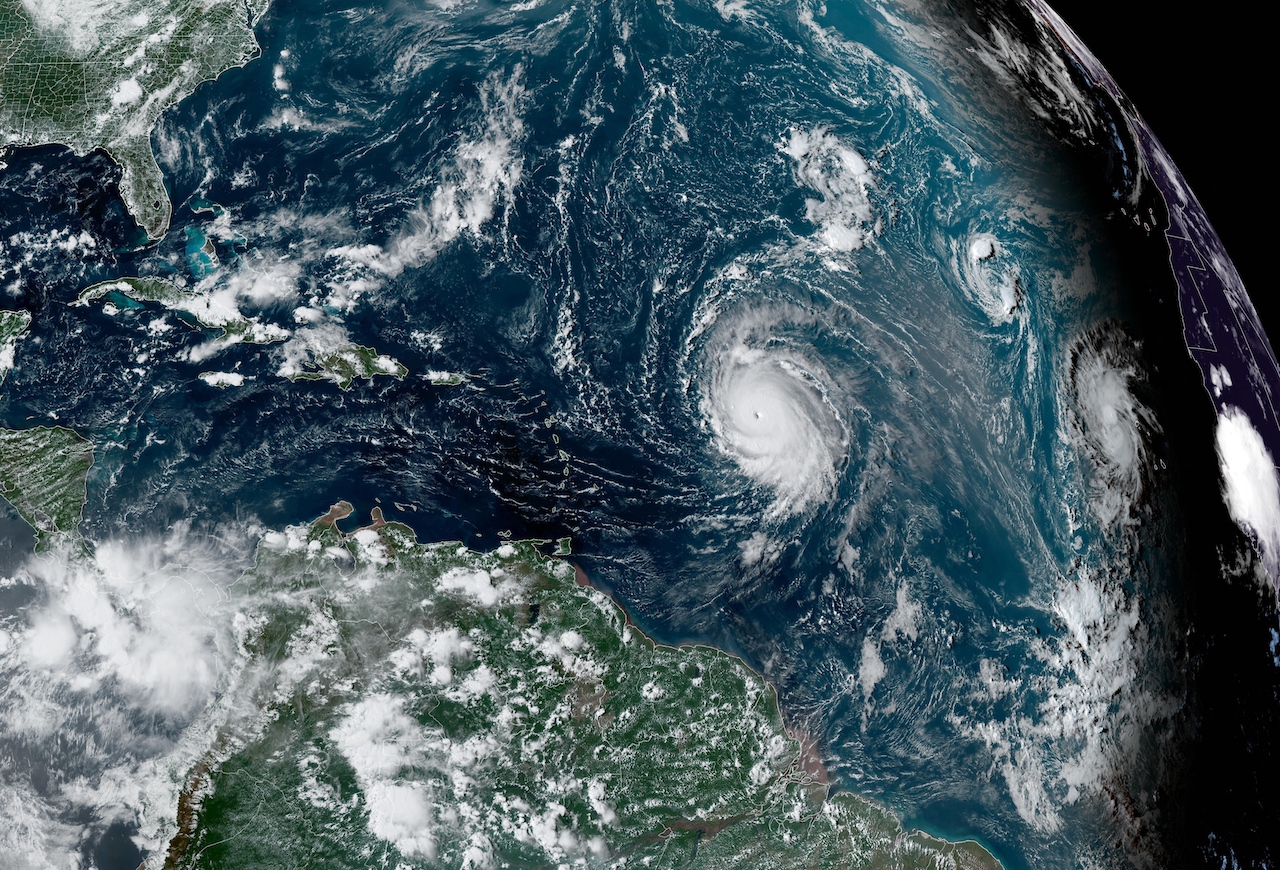

Ruoff agrees: “Our current view on scientific evidence is that there has not been an increase in frequency for very large hurricanes, however we do expect an increase in severity. Partially this will be because what used to be category one and category two storms will instead develop into category three to category five storms, driven predominantly by warmer sea surface temperatures. Storms are also more likely to be more severe as they can penetrate further inland. Take the recent hurricane in California where the after-effects went as deep inland as Idaho. It is fortunate that the typical maturity of cat bonds is three years, and the vast majority of instruments have one year risk spread reset features.”

Are there ‘no go’ regions? Ruoff says not. Though an astonishing 40% of cat bonds are covering risks related just to the state of Florida. If there were to be a direct category five hit on Miami, Ruoff admits “you would clearly see a significant long-term effect in the market. But it is my belief that such an event would definitely shake the market but not kill it. Indeed it might well increase demand”. This appears to have been the effect of Hurricane Ian.

Wilson is also optimistic. “Our ability to model and quantify these changes continues to improve.”

Europe next?

Looking to the future, Ruoff’s expectation is that “the market will expand rapidly. It has seen a CAGR over the last ten years of close to 7%. I believe the CAGR is likely to be higher going forward”.

Ware expects more issuers. “Corporates remain the most obvious potential issuers and there have been some early movers such as Alphabet and Prologis. In theory any corporate with natural catastrophe risk is a potential issuer.” In time “we will also likely see increasing issuance outside the U.S. in regions where large protection gaps remain. This could be in developing regions, either from further World Bank issuance or new cedants, but even in Europe you have large underinsured markets as the European floods in 2021 highlighted.”

She concludes, this makes “it the most interesting time in the asset class’s history”.