A GPS cattle tracker, a harvester robot for white asparagus and a packaging-free online supermarket. These are some of the investments of the €12mn Future Food Fund (FFF), a Dutch seed capitalist that invests in innovative agricultural and food technologies.

In short

- FFF was founded and funded in 2017 by 30 experienced entrepreneurs. It also received a public investment from the Dutch Ministry of Economic Affairs and Climate Policy.

- It announced its sixth investment last month.

- Due to increased investor demand, FFF is considering launching a second fund next year.

“We’ve seen the industry change and improve a lot since we started,” Jeroen Kimmels, co-founder and managing partner of Future Food Fund, told Impact Investor.

Last month, FFF announced its sixth deal: a €1.1mn investment in Moovement, an Australian-Dutch producer of electronic, solar-charged GPS ear tags for beef cows in Australia.

“In the early days of the fund’s existence, it was inherently more difficult to find investments compared to now,” said Kimmels. “For example, a company like Moovement would not have existed five years ago. An increasing number of talented entrepreneurs are now also focusing on the food and agriculture technology or ‘agtech’ industry.”

Agtech gaining traction

With the world population forecast to reach 9.9 billion in 2050 from 7.8 billion last year according to the World Population Data Sheet, combined with increased urbanisation and scarcity of arable land and natural resources, high-tech innovation in food and agriculture will become increasingly important to feed the world sustainably.

“The trends that were already there have only grown stronger. It’s all about sustainability now, there is a lot more urgency and there is more opportunity to generate traction,” Kimmels said.

And this attracts investors. There is currently such strong interest in investing in food and agtech, FFF is considering starting a second, bigger fund next year.

“The team is our number one priority”

Future Food Fund invests in Netherlands-based high-growth companies with a cash need of between €150k to €2mn that have been active for no more than seven years. In return for an investment of around five years on average, the fund typically obtains a minority stake of between 20% and 40%.

The startup companies have to be scalable, with the right product or market fit and above all, have strong management. “The team is our number one priority,” said Kimmels. “Do we believe this team will be able to do it in a tough market? And also, is the market big enough?”

“There are many hurdles to overcome, so there has to be an upside. Often, when we talk to potential portfolio companies and you dig a little deeper, it turns out the market they are targeting is actually smaller than they had initially anticipated.”

This is due to the variety of growing methods, climates and crops in agriculture, and steep competition in the food sector, Kimmels said.

“It certainly helps that we have developed a deep understanding of the industry; our advice can sometimes lead to the companies deciding to refocus during the investment process,” he said.

Banking on global businesses

With its latest investment FFF is banking on Moovement’s global expansion. The company will use the funds “to accelerate growth in Australia and to expand in the US, Africa and South America,” Moovement co-founder Pieter Vogels said in a press release.

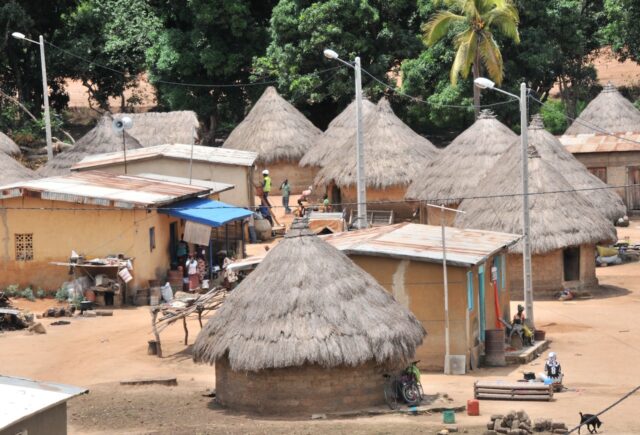

Its potential market is vast: worldwide there is more than 400 million head of cattle, mostly in the remote regions of Australia, sub-Saharan Africa, and North and South America.

The Moovement trackers give farmers an insight into their herds, which means they can be managed in a more efficient and sustainable way. The same goes for Thatchtec, which raised €1.5mn from Brightlands Agrifood Fund and FFF in May last year.

FFF has high expectations for the biotech company, which uses a unique plant-based protein mix to restore and strengthen soil health. This offers both a cost-competitive and sustainable solution for suppressing weeds.

“Their technology can be applied to many product/market combinations, for example, bananas in the Philippines, strawberries in Germany, lettuce in California or flowers in Kenya,” said Kimmels.

Other FFF investments are packaging-free online supermarket Pieter Pot; biodegradable foam producer Foamplant; AvL Motion, which produces harvester robots for white asparagus; and biotech company Phenospex.

Finding the next disruptor

Although the Netherlands has a long history of innovation in food and agriculture, trying to become the next big disruptor in food and agtech isn’t easy, said Kimmels.

“The team has to be a Jack of all trades when it comes to startups in this sector,” said Kimmels, who was an investment banker at Dutch banks Rabobank Groep and ABN Amro for 20 years.

FFF gets around 100 serious approaches from companies a year for financing, with the fund typically investing in “two to three” companies a year, Kimmels said.

The 30 Future Food Fund investors all have proven track records and networks in the food and agriculture sector, and will often act as mentors and consultants to the startup companies.

“Compared to other sectors, in order to gain meaningful traction, a lot more expertise, time and funding is required,” in food and agriculture, Kimmels said.

“The company often needs to expand its management team, because you need both startup and industry knowledge in your team, or else you may not take full advantage of the opportunity and burn through your money fast. So we spend a lot of time assessing management teams and, in some cases, helping it to become more well-rounded before and after the investment.”

Learn more

Rabobank research report on digital agriculture