Niki Mardas, executive director at Global Canopy, discusses his mission to wake up investors to the damage being done to the world’s forests and natural capital risk

In brief

- Around 80% of the Earth’s biodiversity is found in the tropical rainforests – their erosion is leading to a significant loss of natural ecosystems.

- In addition, deforestation is directly contributing to climate change, and a major contributor to human rights abuses.

- 80% of investors don’t have a policy on deforestation – they need to get a handle on this aspect of their natural capital risk.

- Ultimately, however, it is going to be action by governments that moves the dial.

Global Canopy (GC) was founded in 2000 as a network of scientists pooling knowledge about tropical rainforests. The original founder was scientist and entrepreneur Andrew Mitchell, who handed over the baton to Niki Mardas seven years ago.

Since then GC has evolved into an organisation which seeks to focus financial institutions on the impacts and dependencies around deforestation, and to encourage a focus on “natural capital”. Mardas describes the organisation as a “data-driven non-profit which is looking to end deforestation”. In his opinion, deforestation contributes 11-20% of global emissions.

The organisation is funded by the Norwegian, Swiss, and UK governments as well as a series of private foundations. The Gordon and Betty Moore Foundation in the United States is a major backer.

Mission

Mardas sums up the global canopy mission simply. “Our work is to end deforestation. This should be a major priority for everyone, as the effects of deforestation on climate change, biodiversity loss, and human rights are enormous. Investors need to get a handle on their ‘deforestation exposure’.”

In order to achieve this, GC aims to make the connection between financial markets and deforestation more transparent using data.

GC works with a number of different data providers. Its Forest 500 report ranks 350 companies and 150 financial institutions exposure to deforestation. Accessing publicly available documents, it gives each of these institutions a score on how they are approaching the issue of deforestation.

The intention is to expand the number of financial institutions taking part in the initiative which has started with the Deforestation Action Tracker, a tool that assesses all the financial institutions in the Glasgow Financial Alliance for Net Zero (GFANZ) and The Race to Zero.

The first step is to look at companies’ exposure to soy, beef, palm oil, pulp, and paper, and at the regions in which they operate.

The scale of the challenge

Something like 80% of the Earth’s biodiversity is found in the tropical rainforests. Their erosion is leading to a significant loss of natural ecosystems. Mardas argues “it is important for investors and companies to recognise the set of very serious risks associated with nature risk”.

And yet, GC has found that some 80% of financial institutions have no policy on deforestation at all. “The problem is there are so many companies that are not out of the block yet. This is unacceptable,” says Mardas. He wants investors to recognise the risks they have with their supply chains, and to put a policy in place to signal to the marketplace. Doing so will garner a better score from GC.

Mardas admits GC is therefore a governance-led organisation with what he describes as “proxies for impact”. One of GC’s other initiatives, developed with the Stockholm Environment Institute, is trase.earth which uses customs and trade data to give greater transparency on deforestation supply chains.

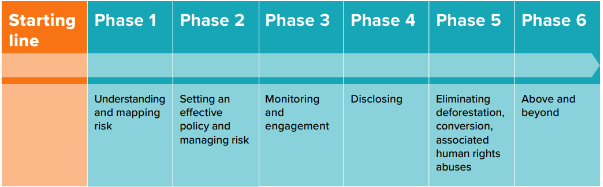

“Investors are directly funding deforestation. They have to understand their link to what is happening in order to stop this.” Mardas proposes a road map for investors (see image below) and is passionate that deforestation is the most important thing for them to focus on.

“It’s a given now, that net zero is impossible without action on deforestation. Just look at the letter making this point by Mark Carney et al.” He also argues deforestation is linked closely to human rights abuses, whether that is infringement of land rights or poor labour practices.

“If an investor had only one thing to do from an impact point of view then that thing should be deforestation. Especially as there is a serious risk of us nearing a tipping point in the Amazon and other major rainforests,” says Mardas.

Forest IQ

GC’s latest initiative is Forest IQ. Together with trase.earth, it aims to give investors an assessment framework based on a single methodology, taking data from a variety of sources, and bringing it together in a single platform.

Forest IQ is particularly aimed at financial institutions. The initiative was created working with ten financial institutions: Allianz, AXA, Blackrock, BNP Paribas, Credit Suisse, Fama Investimentos, Federated Hermes, HSBC, Lombard Odier, and Storebrand.

As well as Forest IQ, GC offers specific guidance to pension funds, and has developed an investment mandate especially for family offices and foundations. “For family offices and philanthropic institutions, we aim to give them what we call a decaf toolkit – a deforestation conservation and human rights abuse-free framework,” says Mardas.

A family office gave GC the idea for this initiative when they wrote to three different asset managers and had three very different responses about their actions. “What our decaf mandate does is give investors a stress test they can apply to their investment managers.”

Means to an end

Mardas declines to describe GC as a lobbying organisation, but admits to “seeking legislative change”. “Our conclusion is that sector-wide change will not come from our Forest 500 with its emphasis on governance. It will come through legal action which will require companies to have better disclosure and traceability. In some ways we’re a research-driven think tank with data platforms.”

GC has worked closely with the EU Commission on deforestation and has put in place a legal structure that represents a fundamental shift. While Mardas cautions they “don’t think it reaches into financial reporting as far as it should do” he hails it as “a step in the right direction”.

And a very necessary one. Mardas concludes: “Deforestation is the cause where climate-meets-nature-meets-people. And the presence of a tipping point risk just enhances the urgency of action.”