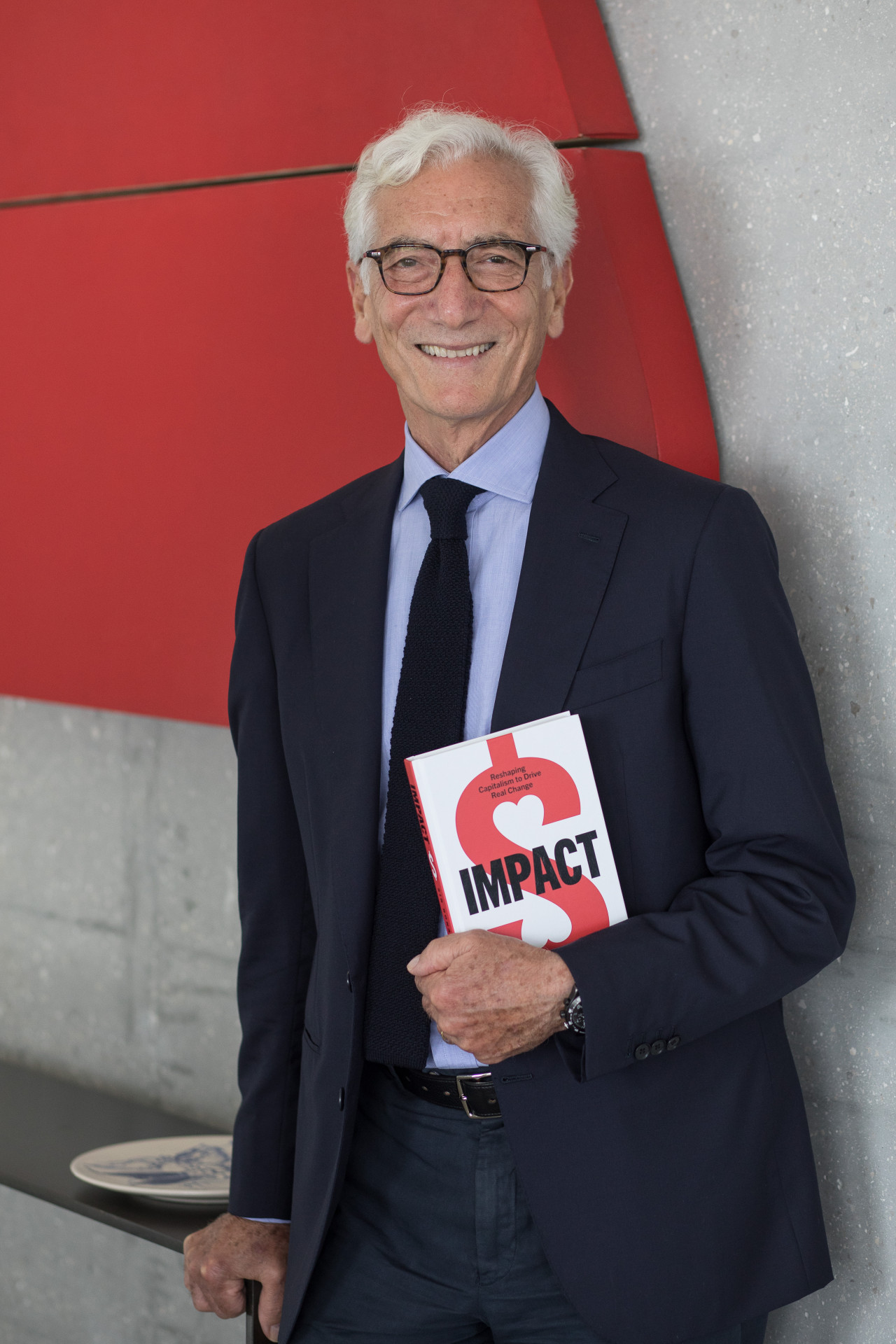

Leading the ‘Impact Revolution’ – now in paperback, Ronald Cohen’s classic remains a best seller for good reason.

In brief

∙ Ronald Cohen, the ‘Godfather of impact investing’ shares his wisdom

∙ We discover just how far impact investing has come, spawning a new class of entrepreneurs, and working huge changes at even the biggest companies

∙ But it’s not over. Better impact measurement will drive the revolution to new gains

∙ This has huge implications as we “move beyond the selfish capitalism of today”

Sir Ronald Cohen doesn’t mince his words. “I am writing this book because I can see that a solution is within our grasp: I call it the ‘Impact Revolution.’

Cohen was the co-founder of Apax Partners, the global private equity firm. He decided he would leave Apax at the age of 60 because: “Giving back is an important aspect of my values and I did not want my epitaph to read, ‘he delivered a 30% annual return on investment’. I’ve always known that life should have a greater purpose.”

A crucial element in Cohen’s make-up is his experience as a childhood refugee. Cohen was born in Egypt and left as a refugee at the age of 11, when his family came to the UK.

“Life should have a greater purpose”

The problem he sees is “inequality causing huge migration from poorer countries to richer countries” and that “the challenges arising from absorbing these immigrants are exacerbating the inequalities that already exist.”

No wonder he is particularly inspired by entrepreneurs like Hamdi Ulukaya, a Turkish migrant who founded US yoghurt company Chobani, which “ensures 30% of employees are refugees or immigrants.” And Jerry Rubin’s Through Pathways, which seeks to “help refugees and immigrants” improve their language skills and get jobs.

Cohen has achieved much – including Social Investment Bonds

Since that decision to give back, Cohen has achieved much. He chaired the G8 and the UK Social Impact Investment Task Forces, founded Social Finance UK, and is now Chairman of the ‘Global Steering Group for Impact Investment.’ And much more.

One of his greatest achievements is detailed in this book: the creation of Social Investment Bonds (SIBs). He tells us: “This is not a bond in the traditional sense (but)… an outcome-based contract for services” in which “a socially motivated investor…eliminates the commissioner’s risk.”

Cohen created SIBs at Social Finance, where he sought to reduce prisoner reoffending rates in the UK. He pulled in investors from seventeen charitable foundations including the Rockefeller Foundation and the Esmee Fairbairn Foundation, and his ‘Peterborough SIB’ “achieved a 9.7% reduction in the number of convictions, and paid investors 3.1% a year on top of their capital.”

The revolution begins

Cohen asserts SIBs acted as “the most prominent catalyst of…new approaches,” because they “demonstrated that it was possible to link the funding of a project to its impact on society. By doing so it was able to attract private capital.”

He believes this spurred the rise of impact investing, and created ‘the children of the revolution.’ “Across the world, young entrepreneurs are bringing innovative solutions to our most vexing problems, capitalising on the new technologies that their predecessors brought to the world.”

Frighteningly young entrepreneurs at that – robotics entrepreneur Keller Rinaudo created life-saving medical drones at 23, Luke Hines repurposed driverless cars to help the blind at 27, and Iyinoluwa Aboyeli created tech talent centre Andela in his early 20s.

Interestingly, “the driving force behind the venture was the belief that brilliance is evenly distributed across the world, opportunity is not.”

Cohen chronicles the revolution in larger companies too. How German sportswear maker Adidas recycled ocean plastics to make 6 million pairs of shoes, French diary giant Danone created its Dynamic Communities entity, and IKEA promised 100% ‘circularity’ by 2030.

Going to the next level – IWAI?

What next? Well, according to Cohen “monetisation of impact pushes portfolio theory to the next level.” IWAI, the Impact Weighted Accounts Initiative incubated at Harvard Business School, will “give a monetary value to the social and environmental impacts created by businesses.”

This is yielding “interesting insights” across 3,500 companies. For example, Coca-Cola generates half of PepsiCo’s revenue, but “its impact through water use alone resulted in an environmental cost of $2 billion,” five times PepsiCo’s.

Likewise, comparing ExxonMobil, Shell and BP using this methodology makes ExxonMobil “stand out as the least environmentally efficient of the three rivals.”

Apparently it is also “time for governments to grasp the new model of risk return impact.” He believes in ‘pay for outcome approaches’ to public service procurement, and argues governments “access public money” such as “unclaimed assets in banks” (something Cohen was instrumental in persuading the UK government to do).

A sense of hurry

One is left with the impression that Cohen is in a hurry. “It will take at least a decade to transform our system,” he states. Maybe ‘only’ would be more appropriate.

But then again, if “impact is an idea whose time has come,” perhaps this is in fact the time to “move beyond the selfish capitalism of today, overthrow the dictatorship of profit, put impact firmly by its side to keep it in check, and usher in a new era of impact capitalism.”

Who knows, there may yet be a revolution.