The UK-based startup, whose environmental DNA technology is able to produce data on thousands of species at once, will use the funding to scale up its biodiversity monitoring platform.

NatureMetrics raised $25m (€24.4m) in a Series B funding round led by Just Climate, an investment firm established by Generation Investment Management, the company co-founded by Al Gore. Other investors include EDF Pulse Ventures and the Monaco ReOcean Fund, as well as existing investors 2150, BNP Paribas, Ananda Impact Ventures and SWEN Blue Ocean also took part.

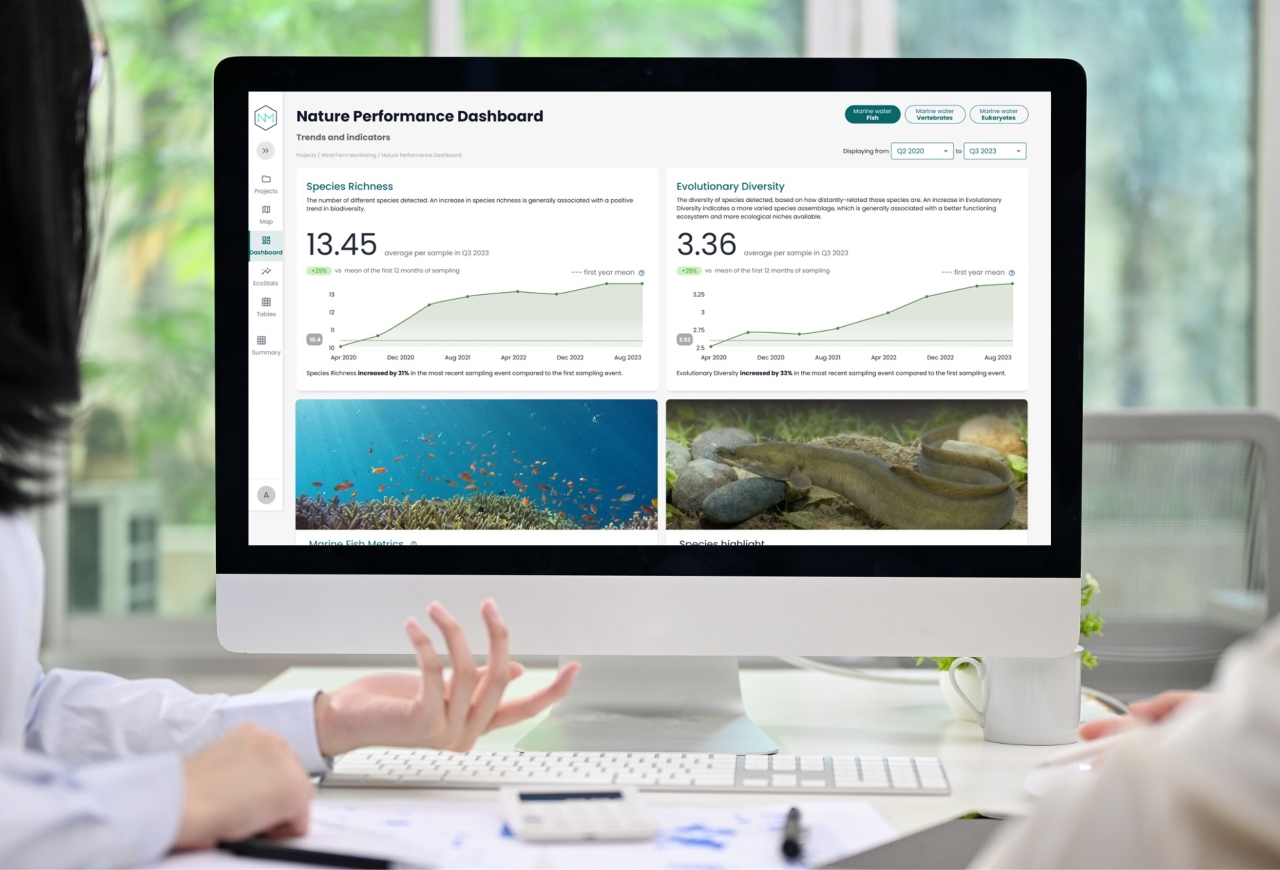

NatureMetrics will use the funding to “really leverage our digital platform to make the data more accessible”, to its customer base, Dimple Patel, chief executive officer of NatureMetrics, told Impact Investor.

“So bring it to life, help users really interact with it and extract the information that they need to drive their decision-making and their actions, but also to disseminate that data more widely. Because fundamentally, when you are leaning into operational impacts and you are leaning into the financial impacts of biodiversity, there are some pretty big numbers at play.”

Take for example the agriculture industry, where “biodiversity and soil health impacts your crop yields, so that’s your cost base, and also linked to your supply” Patel said. Accurate biodiversity data can also provide clients with valuable insights when it comes to obtaining building permits or developing new wind farms, she said.

Biodiversity insights

NatureMetrics, which was founded in 2014 by Kat Bruce, a tropical ecologist, provides biodiversity insights and solutions to more than 600 clients in over 110 countries.

The firm does this by collecting and detecting tiny traces of DNA in water and soil samples, which are analysed to identify every type of organism in an entire regional ecosystem. Its global customer base includes consumer goods giant Unilever and mining company Anglo American, as well as major conservation groups, including the WWF.

As previously reported by Impact Investor, NatureMetrics hired Patel, a former Goldman Sachs banker and an entrepreneur, in 2023 to scale up the company. The firm wants to use the fund to expand internationally and grow its data, AI and digital capabilities.

Investor reaction

Demand for evidence-based data and insights has risen in recent years following the introduction of nature reporting obligations such as the EU’s Corporate Sustainability Reporting Directive and the Taskforce on Nature-related Financial Disclosures.

“We believe that companies across industries seeking to protect and restore nature within their operations and supply chains lack the high-quality data they need to act with confidence,” said Siddarth Shrikanth, director, natural climate solutions at Just Climate.

The nature-based solutions market is estimated to be worth around $154bn a year, according to a 2022 State of Finance for Nature report by the United Nations.

“NatureMetrics combines the power of environmental DNA technology with a range of other data sources to generate actionable insights, and we are delighted to support their scale-up journey at a critical moment for global biodiversity action,” Shrikanth said.

NatureMetrics, a finalist of last year’s Earthshot Prize, has so far uncovered 9% of the earth’s environmental DNA (eDNA), and detected more than 300 threatened species.

The firm’s eDNA technology “aligns perfectly with our vision of protecting natural resources while advancing infrastructure projects”, said Julien Villeret, chief innovation officer at EDF Group.

Fundraising challenges

NatureMetrics secured the commitment amidst a “tough” fundraising environment, Patel said. “What was really working in our favour is just some of the awareness around biodiversity, and that we’re starting to really grow within the sustainability space.”

The due diligence process, which lasted from March through the end of December last year, “was nothing I had come across before”, Patel said. This included looking at the firm’s orders placed in the five months preceding the deal, Patel said.

“The risk environment looks very different now, there is much more focus on economics,” Patel said. “So what does your path to profitability look like? Do you have a business model that is fundamentally going to get you to financial sustainability? And can you show traction against that based on customer behaviour and acquisition rates? It’s really about building the credibility behind the financial modelling”, said Patel, who expects the company to break even by mid-2026.