Around 35% of all impact funds invest in emerging markets, according to the latest report by Phenix Capital. SDGs 7 (affordable and clean energy) and 1 (no poverty) are the most targeted among emerging market impact funds

Nearly one-third of all impact funds are investing in emerging markets, according to the latest impact report by Phenix Capital Group.

Out of the 2050+ funds, 729 target emerging markets, with more than €96bn committed towards emerging market funds since 2015.

The report is based on data from Phenix’s Impact Database, which includes impact investment funds from across the world.

Mobilising more capital into emerging markets is essential for financial institutions to deliver on the Paris Agreement and reach the UN Sustainable Development Goals (SDGs) on time.

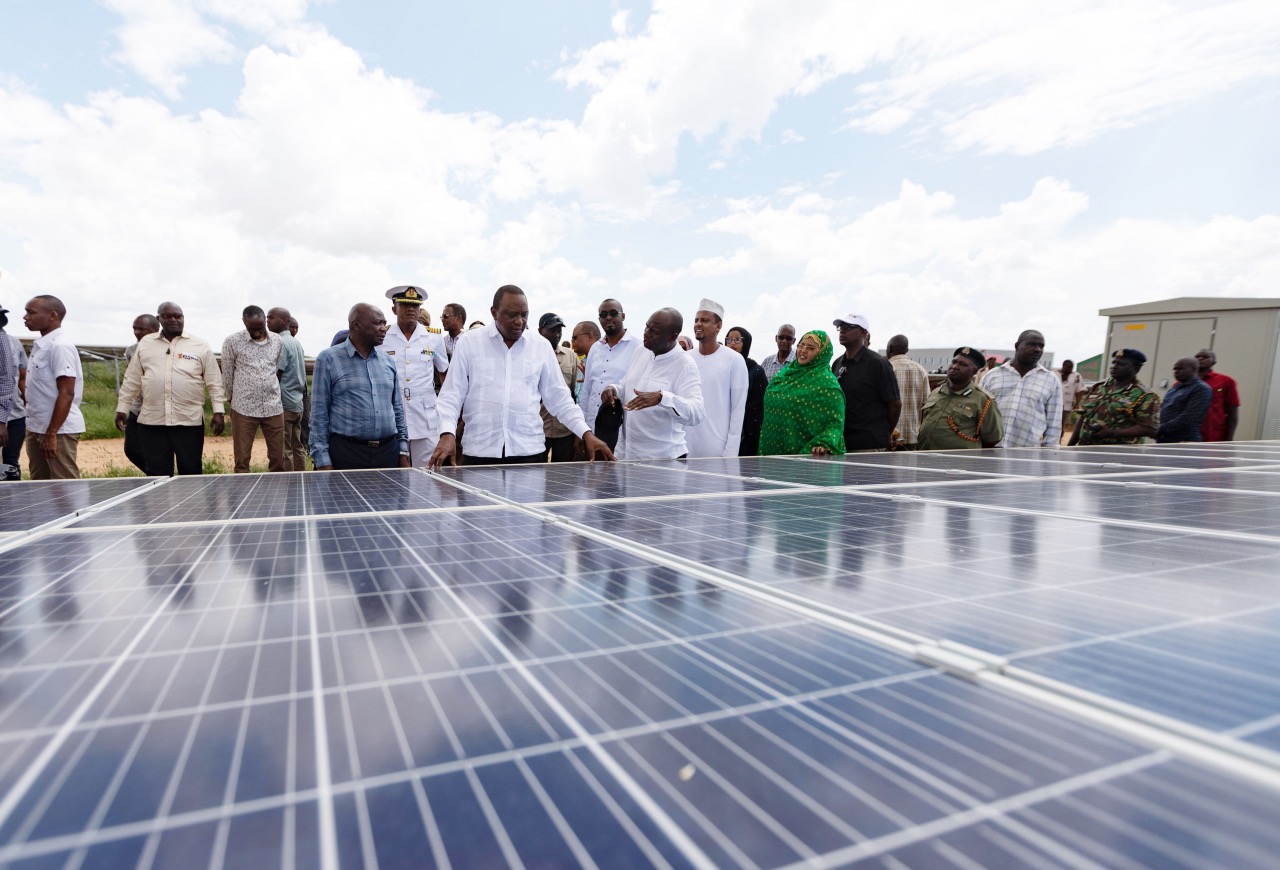

The report also looks at the specific SGDs that most of the funds are focused on. It shows that, historically, SDG 7 – affordable and clean energy – was the most targeted by emerging markets funds, attracting more than €38bn in historical capital commitments. Currently, however, SDG 1 – no poverty – is in the lead.

Geographically, the top three regions emerging market impact funds have historically targeted are Southern, East and West Africa. Regarding asset classes, both historically and currently, emerging market funds are primarily investing in private equity, private debt and infrastructure.

AfDB and Proparco

In terms of impact themes, energy access scarcity has been the main focus across emerging markets, attracting €36bn in historical capital commitments. Currently, financial inclusion is ahead, with €29bn.

According to Phenix’s report, 284 emerging market funds are currently fundraising, hoping to raise a total of €40bn collectively.

The report also includes interviews with two key players in the sector, the African Development Bank (AfDB) and French development finance institution Proparco.

Commenting on what is missing for scaling up impact investment in Africa, Eren Kelekci, chief investment officer, food and agriculture, textile and forestry, at the AfDB, said: “Be innovative, go beyond traditional settings and develop deal structures that leverage different forms of capital, develop further the whole ecosystem to develop and broaden exit options and incentivize the supply of capital across the risk/return curve.”

Jeremie Ceyrac, head of private equity at Proparco, added: “Companies operating in emerging and developing markets are faced with daily challenges such as reduced access to energy, high costs of logistics, and difficulty to recruit human talent, to name a few. Nevertheless, investment opportunities are available if you know where to find them.”