The annual ‘PYM Impact Days’ gathering for wealth owners is taking place in Driebergen this weekend, under the title ‘Imagining the New Economy’.

The 2023 PYM Impact Days will take place this weekend, 23-24 April, under the title ‘Imagining the New Economy’. This annual event is part of PYM’s efforts to connect and guide wealth owners to invest their capital consciously to benefit people and planet.

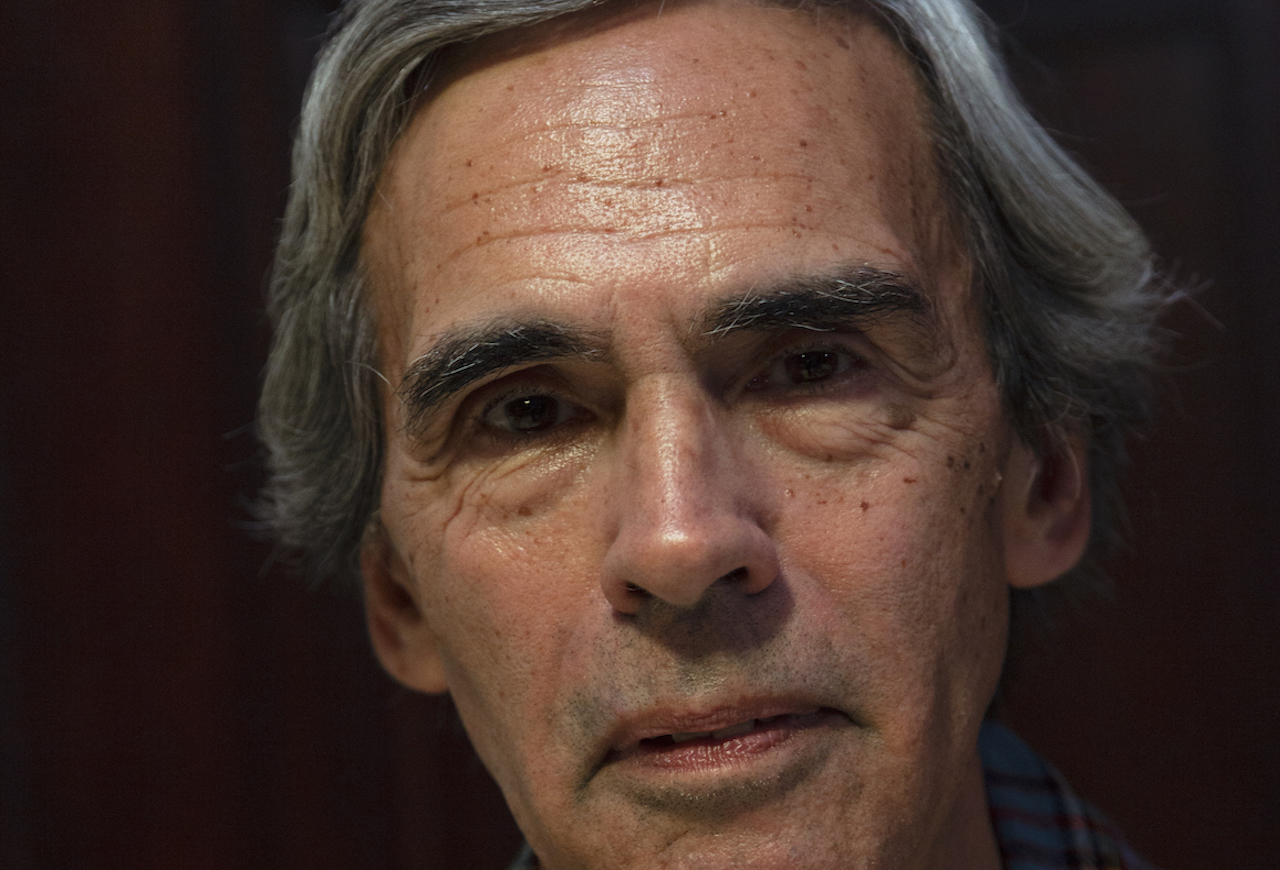

This year’s agenda will explore the role of businesses and impact investors in building a new economy that works for everyone. Ignaz Anderson, director of the Donor Impact Invest Fund and content director at PYM, sits down with Paula Garrido to discuss why the current economic system is not working, what can be done to drive change, and the role of impact investors on this journey.

Paula Garrido: Why is the current economic system not working and is it possible to change it?

Ignaz Anderson: The current system is not working because as we all know the rich and getting richer and the poor, poorer. The concept of shareholder capitalism where company profits flow more and more only to shareholders, and employee wages stay low is unfair and needs to change.

At the same time, those advising wealth owners at commercial banks normally direct their clients to investments that prioritise financial returns over social impact. We are very lucky to have trusted partners in our community that are banks and we want to bring more consciousness into this process.

There is currently an exhibition at the Kunstmuseum in The Hague called ‘The Future of Money’ which depicts the failures of the current system very well, and highlights how the current rules are not in line with what is needed to change the money system.

Banks, not just commercial but also central banks, pension funds, and tax authorities have all a role to play and some changes are taking place, but very slowly. So we think we need to start with private capital.

PG: How would a “New Economy” look and feel like?

IA: It has to be values-based. We are inspired by the Earth Charter movement which started over 20 years ago and built on a number of principles that seek to turn conscience into action and give civil society more power and shared responsibility to build a more just, sustainable and peaceful global society.

I see the new economy as being more local and community-based, and more equal. An economy that gives more ownership to the stewards who work towards delivering the societal-mission of the business, and not only based on directing profit to company owners who could sell it in a couple of years. Steward-ownership, as Patagonia shows, is more just for people and Earth.

Otto Scharmer, one of the speakers at our event, talks about the idea of going from “ego to eco”, meaning moving away from the traditional ego-led approach to running a business to one that is more focus on the mission itself. We need to move from financial-driven to social-driven. This asks for a systemic-change. We see that on a deeper level the polycrises are all connected.

The new economy should also be less transactional and more based on relationships, and more in balance with nature. This is why we invited Kate Raworth as well to talk about regenerating the environmental and social relations.

PG: What will be the role of businesses and who will share their ownership and successes?

IA: Although this might sound strange, we see entrepreneurs as artists who are part of this whole process, and thanks to their ‘artistic’ mindset they can also help shift our consciousness.

Businesses should be more in balance with nature, with fairer ownership structures and more focused on value-creation and not just on money-making. I see this starting to change, for instance businesses based on the share economy which allow you to share your bike or tools, so the mission of the business benefits the local community. We are also seeing progress on regenerative and circular economy models.

PG: How would you describe the role of impact investors in this new economy?

IA: I see impact investors as the creators and facilitators of a more socially driven economy. That’s what impact investing is for me. I also see impact moving from broad impact to deep impact – for instance the broader impact would be to get plastics out of our oceans, whereas the deep impact would be to stop plastic ending up in the ocean in the first place, going up the river, to the source.

Today around 50% of all the largest institutions are financial institutions and I hope that will be less and less in the future. We need to provide support to drive real change in the right places and also fight inequality in the world. I think things will change when we put ourselves at the service of others and are more aware of what the needs of others are, and impact investors can play an important role there.

PG: Finally, how can we convince wealth owners to take a more active part on the journey?

One of the ways to do this is to have meetings like ours where we discuss key topics such as politics, democracy, or the media, all the way to climate and refugees. All of these questions are knocking at our doors, and we need to do something about it. Changing policy about climate or refugees, for instance, is not easy but private capital is not dependent on politics – you can make a difference if you want to.

These meetings are crucial to exchange ideas and build communities of conscious investors. You cannot really change the system without changing yourself. It is all about behaviour – before we might have looked at what the church, the law, or the government said about whether we should look after nature, for instance. But we now recognise that it is not up to the government or the church to tell us what to do. It is a private issue, a question of values , and we see more and more communities being built around shared values.

PYM Impact Days will take place on 23-24 April in Driebergen, The Netherlands. More info and registration.