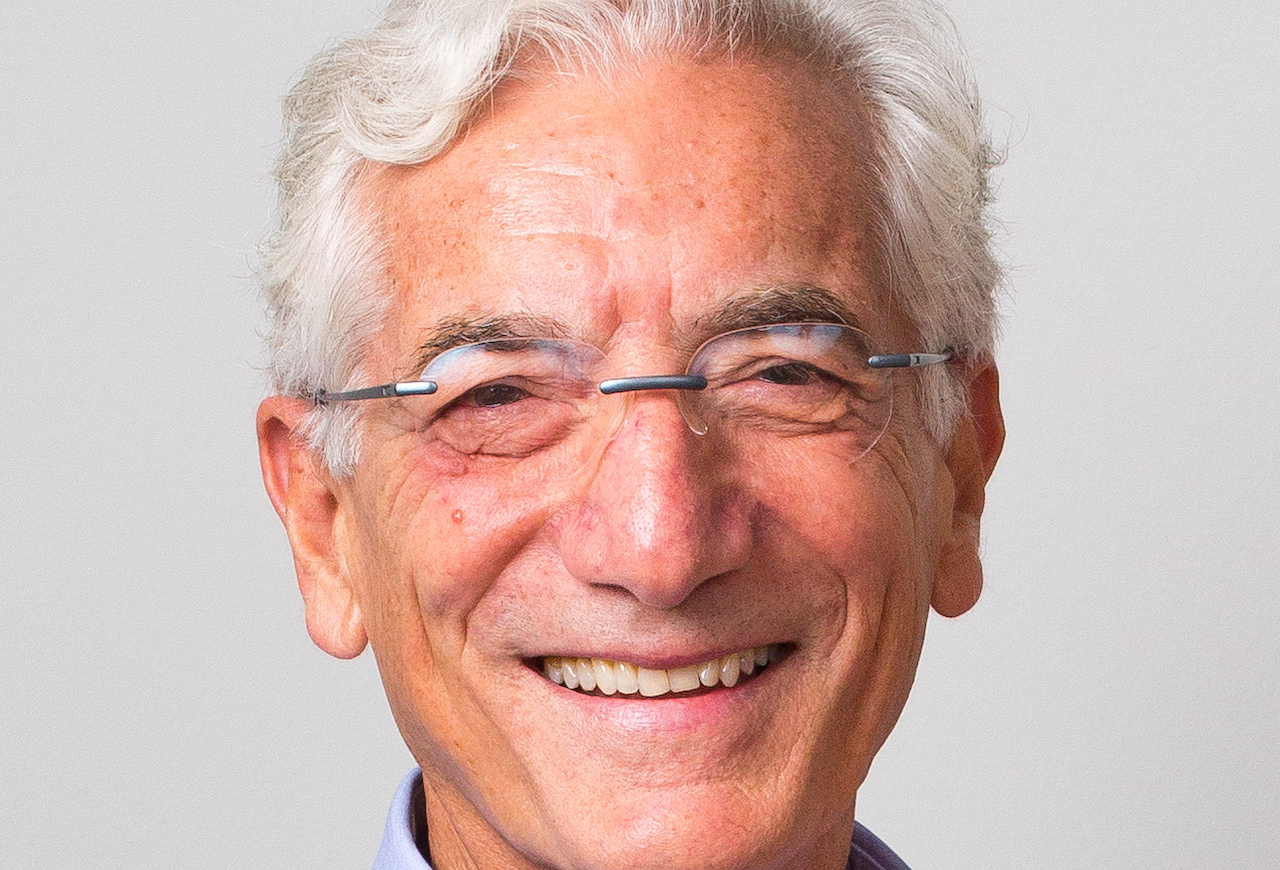

Pioneering impact investor Sir Ronald Cohen, president of the Global Steering Group for Impact Investment and chair of the International Foundation for Valuing Impacts, reflects on the sector’s progress and outlines the path forward.

Paula Garrido (PG): Looking back over the last two decades, has the impact investing sector developed in the way you envisaged 20 years ago?

Ronald Cohen (RC): Impact investing has gone much further into financial markets than I would have expected in 2003. When you consider that sustainability-linked bonds, sustainability-linked loans and other forms of impact investment are now worth more than $2trn (€1.8trn) — that’s more than we expected. When we wrote the G8 Taskforce Report in 2014, ‘The Invisible Heart of Markets’, there was a chapter titled “The First Trillion”. It still seemed a very long way off then.

Less successful has been the penetration of impact thinking in government and philanthropic spheres. The social impact bond and its cousin the development impact bond have only attracted about half a billion dollars. True that it has gone to more than 250 pay-for-success initiatives across 30 countries to tackle a dozen social issues. But the numbers have been kept low because of the lack of institutional readiness to accept the new thinking.

This is despite the fact that the evidence is that pay for outcomes approaches cost half as much as direct funding and achieves better results while it also generates a wealth of valuable data to guide policy making.

PG: What do you think have been the most interesting recent developments in the sector that can contribute to its future growth?

RC: The most interesting recent developments are the creation of the ISSB (International Sustainability Standards Board) and the proposals of the SEC (Securities Exchange Commission). These effectively bring impact transparency to the mainstream, standardising the way we measure quantity metrics relating to social and environmental issues in the case of ISSB which spans 132 countries, and relating to environmental issues only in the case of the SEC.

We’re coming very close now to mandatory disclosure of quantity impacts by companies. The work of the IFVI (International Foundation for Valuing Impacts), which I’m privileged to chair, in bringing standardised valuation to these metrics will bring impacts in a rigorous way into financial analysis and the valuation of companies. This will represent a watershed moment in the way companies are valued and drive our economies to optimise risk, return, and impact.

The effect of rigorous measurement of impacts will be huge. It will mirror the revolution in investment management which followed the rigorous measurement of risk at the beginning of the 1950s, bringing new concepts into play such as risk adjusted returns and portfolio diversification and optimisation.

Already we see negative correlations arising in many sectors between the amount of pollution companies create and lower stock market valuations. As more reliable impact data is offered by data providers and used by investors in their decision making, a powerful incentive will be created for companies to deliver both profit and impact performance at the same time.

PG: In your book, ‘Impact: Reshaping capitalism to drive real change’, you introduce the concept of an ‘Impact Revolution’. What are key steps we need to take to drive this real change, and how long do we have to get there?

RC: I believe that impact transparency is the next big step and that we will see impact accounting come into being over the next two to three years. I expect some countries to mandate the publication of impact statements within this timeframe. These statements will show in comparable monetary terms revenues, costs, and impacts a company creates broken down between its operations, employment practices, products, and supply chains.

PG: Finally, is impact investing really delivering on its social and environmental goals, and what needs to be done to accelerate the further mobilisation of capital to scale up impact?

RC: In order to accelerate the mobilisation of capital to scale up impact, we must concentrate on adoption by the G7, G20, and the OECD. Already we have seen the G7, under the UK’s presidency, in 2021, set up the impact taskforce which published its important report ‘Time To Deliver’ in December 2021.

The Japanese presidency of the G7 in 2023 created a global impact investment health initiative. India in the same year, as president of the G20, focused attention on life economies, which area version of the impact economies described in my book. The next step is for these authoritative bodies to adopt impact investing as the most powerful way to raise the capital necessary to achieve the SDGs.

Sir Ronald Cohen is president of the Global Steering Group for Impact Investment (GSG) and chair of the International Foundation for Valuing Impacts (IFVI).

This article is part of the editorial content of the Impact Investor Guide 2024. You can download a digital copy of the guide here.