GSG Impact and its National Partners recently came together for the organisation’s annual meeting. The event provided a unique perspective into the state of global impact, writes GSG Impact’s Krisztina Tora.

Today GSG National Partners (NP)s represent 44 countries, with seven new partnerships becoming accredited in 2023 – Belgium, Greece, Malaysia, Norway, Peru, Sri Lanka and Thailand. Since the start of the year, we have also been joined by NPs in Kenya and Cambodia. We now cover 50% of the global population. Half of our NPs now represent countries and regions in the Global South.

This year’s annual Global Leadership Meeting, held for the first time in Latin America and hosted by our regional partner for Central America, gives a timely opportunity to shine a light on some of our NPs’ initiatives which are driving the expansion of impact in emerging economies.

Global challenges, local solutions

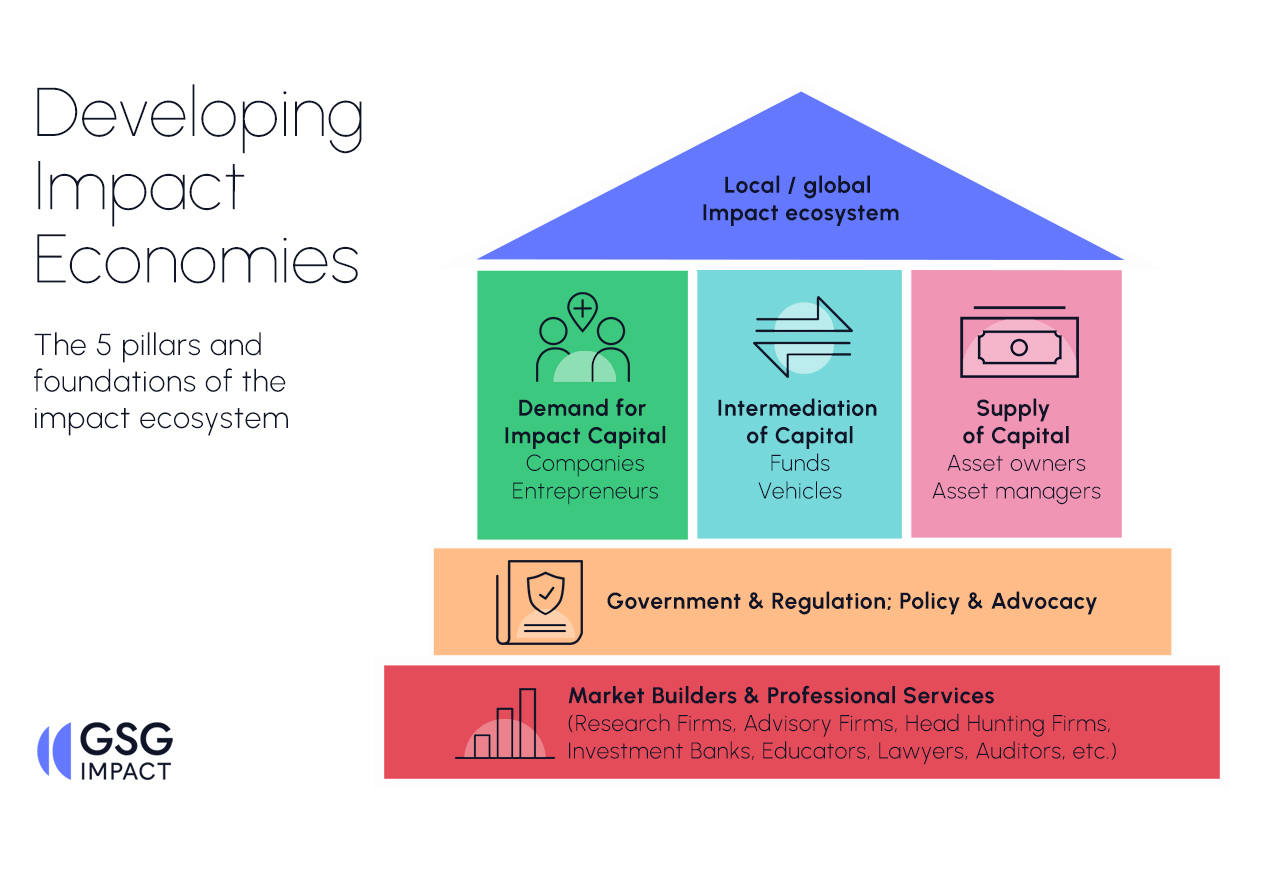

Every NP is independent, accredited by GSG Impact. To achieve NP status, amongst other criteria, its membership must be representative of the elements of an impact economy. Each NP is created by, and for, the local ecosystem using the GSG Impact methodology. While every NP is free to set their own priorities, there are common themes. Over 90% currently prioritise the development of their impact ecosystems, through strengthening, or pulling the lever of one or more of the elements below. What differentiates the work is the local context.

One key exercise in developing an impact ecosystem is understanding the state of the market. Many of the more established partners did this a decade ago, for some the first market mapping exercises took place last year. In Central America, our Regional Partner identified over 140 key impact actors and pinpointed innovative high-impact projects, enabling synergies between initiatives.

In Thailand the exercise covered an array of sectors important to that market such as education, sustainable tourism, oceans and forests. A next step is the production of annual research. For the fourth year in succession our India NP reported on the annual impact investment trends, breaking down the $2.9bn (€2.6bn) of impact equity deals that took place in 2023. A more recent research project is a detailed examination of the Indian market for climate tech.

Mobilising capital for impact

Another major priority area is capital mobilisation with almost 80% of NPs developing financial instruments and/or facilitating deal flow. One major theme for them is the development of impact wholesalers and impact funds of funds. Leaning on the expertise and experience of NPs in countries where these have already been established, and supported by practical advice from GSG Impact, a number are being operationalised, or are already in place, including in the Global South.

The $75M Ci-Gaba Fund of Funds, sponsored by our Ghana NP, is designed to support the development of the West African venture capital ecosystem. Our NP in Nigeria is leading the development of the Nigeria Wholesale Impact Fund, with a commitment of $50M from the government. The fund will ultimately finance social enterprises and smaller businesses in sectors including agriculture, education, health and energy. In México, Fondo de Fondos, a member of the NP, in partnership with Sonen Capital, raised the $71 million LatAm Impact Fund, which has already made commitments to six funds in the region. Meanwhile in South Asia, the Bangladesh NP has raised $20 million worth in impact funds, including impact-focused mutual funds targeting garment workers.

In terms of matching investors with opportunities, our NPs in Ghana and Nigeria have jointly launched a deal-sourcing platform, Deal Source Africa, proactively matching business to funds. A similar platform, Impact Matching, has been running for two years sponsored by our NP in Chile. While in Sri Lanka our NP runs Ath Pavura a “Dragons’ Den” style TV programme with social entrepreneurs pitching to investors.

Impact through partnership and collaboration

A major part of our efforts at GSG Impact is to support the NPs in their work. Much of this is done by formalising and sharing best practice. This ranges from evidence-based policy recommendations to technical support on developing investment vehicles. For example, a core piece of GSG Impact’s work in 2022 was to explore solutions to the issue of global informal settlements and set the design principles for impact investing tools to enable those solutions. Our NP in Türkiye is leveraging this work, leaning on the place-based investment experience of the UK and Colombia, tailored to their challenges. One result was last year’s launch of the İzmir Historical Kemeraltı Real Estate Investment Fund, a public/private investment initiative to preserve the historical market district of Izmir.

In recent years, as NPs have become more sophisticated, we have seen greater levels of collaboration between the NPs themselves. Last year 31 NPs benefited from collaboration and support from across the GSG Impact Partnership. One example is the 2023 Pensions and Impact Investing report a collaboration between NPs in both the Global North and South, including Argentina, Ghana, Israel, Japan, Netherlands, Nigeria and the UK, providing examples of how NPs have supported pension funds on their journey to impact investment.

At GSG Impact we are also able to harness the insight, and networks, of our NPs across the Global South in our impact transparency work. Last month as a member of the G20 Sustainable Finance Working Group our research to that body, Making Sustainability Standards Work For All, synthesises the output of a series of impact transparency workshops held in conjunction with our NPs in Cambodia, Colombia, Ghana, Mexico, Nigeria and Thailand, as well as our taskforces in Indonesia and Vietnam.

Despite the many challenges that emerging economies face, when I look across the GSG Impact Partnership, its innovation, resilience and above all collaboration, I am confident about the future. Country by country we can bring about a transformation where impact is at the heart of every investment decision, so no one is forgotten or left behind.

Krisztina Tora is chief market development officer at GSG Impact. Every year GSG Impact surveys its NPs covering activity, priorities and governance. This year’s results are available in the 2024 State of Play report.